Are you trying to Reconcile Payroll Liabilities in QuickBooks? Well, here is the answer to all your doubts. In this section, you can learn how to reconcile your liabilities in QuickBooks payroll. Before jumping into the insights let’s discuss a bit about payroll liabilities. QuickBooks payroll liabilities are categorized into two types of categories:

- Employer Expenses

- Employee Liability

These two categories are then further divided into sub-categories that are: federal income tax, state income tax, Medicare withholding, and social security withholding. It is to be considered that some liabilities need to be recorded in the accounts but shouldn’t get recorded in the expense accounts. The balance of these liabilities should be zero. If you think that cross-checking the current and savings bank accounts is the only thing in reconciling, it is more than that. To know about that keep reading this article till the end. In this article, we will provide you the details about reconciling liabilities in QuickBooks payroll. In case of any queries, you can connect to our tech support team by dialing our toll-free number i.e., +1-844-719-2859.

What is the Procedure to Reconcile Payroll Liabilities in QuickBooks?

The below-listed steps will help you reconcile payroll liabilities in QuickBooks. Let’s go through the steps one by one:

Step 1: Create Liability Accounts

- Start the process by creating a list of the liability accounts.

- The list of liability accounts consists of:

- Federal Income Tax withholding payable

- State Income Tax withholding payable

- FICA tax payable

- 401k or retirement benefit premium payable

- Heath insurance payable

Step 2: Create Transactional Labels

- Here you need to create the transactional labels. This is to separate employee and employer payroll liability transactions.

- Now go to the settings option, turn on tagging, and then click on QuickBooks.

- Once you receive confirmation you have to turn on the tags feature by clicking the Done tab.

- After that, create a new tag group by going to the settings tab and choosing the tags option.

- Choose new tab and then tag the group.

- The last step is to name the new tag group payroll liabilities and click on save.

Also Read: How to Fix QuickBooks Error Code H202?

Step 3: Create Payroll Liability Sheets

In this step, just normally set up the payroll liability reconciliation sheets.

Step 4: Print the Reports

- In this step, you have to print the reports from the QuickBooks payroll and general ledger.

- These reports can be printed or else you can send them via email as per your requirements.

Step 5: Reviewing the Transactions

- In this step, review all the payroll liability transactions and also need to reconcile the outstanding items.

- This is an important step in order to cross-check the transactions to avoid any mismatch or mistake.

Step 6: Fixing Reconciling Items

In this step, you have to fix the payroll liability reconciling items.

You might find this helpful: How to Fix Online Banking Errors in QuickBooks?

What is the Procedure to Reconcile Payroll Liabilities in QuickBooks Online?

The below-listed steps will help you reconcile payroll liabilities in QuickBooks online. Let’s go through the steps:

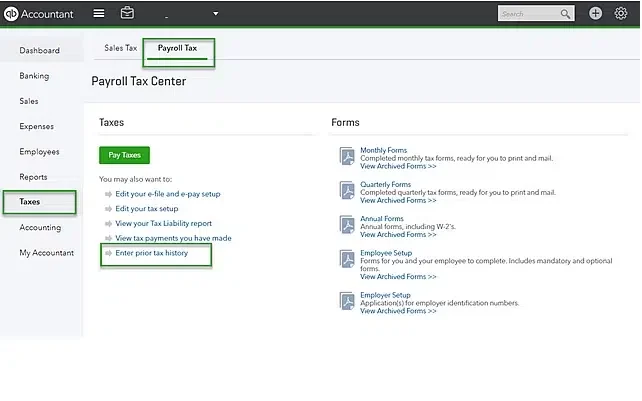

- In the QuickBooks Online Navigation bar select Taxes.

- Now click on the Payroll Taxes option and underpay taxes and click enter Prior tax history.

- Once done with that, select the Current year and Liability period.

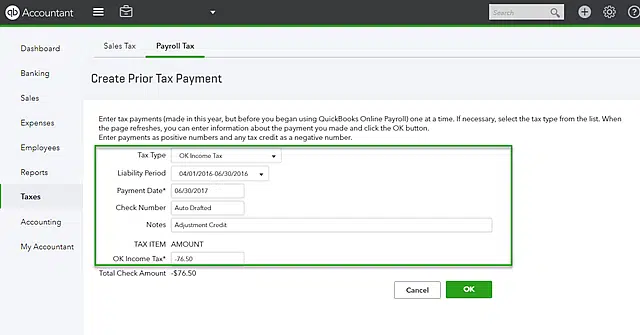

- Also, click the Add Payment option and select the Tax Type to reconcile payroll tax returns.

- Further, you have to enter the Liability period and Period date along with the Check Number and notes.

- The next step is to create credit by creating a negative amount.

- At last, click on the OK button.

Conclusion:

Now moving towards the end of this article we hope that the insights we provided here are helpful for you. The steps mentioned above will definitely help you in Reconciling Payroll Liabilities in QuickBooks. However, if you find this confusing, you can ask for assistance by contacting our tech support team. Our team works 24/7 so you can call us anytime. To contact our team, dial our toll-free number i.e., +1-844-719-2859.

Frequently Asked Questions Related to Reconcile Liabilities in QuickBooks

How do you reconcile your payroll liability account?

- You can reconcile your pay slip using the following steps.

- Check your pay slip.

- A payroll ledger lists all the important details about an employee’s salary during a pay period.

- Also, check employee time cards.

- Check the wage rate.

- Check payroll deductions.

- Then record it in the ledger.

- Submit your pay slip.

How do I make payroll adjustments in QuickBooks?

The following steps may help you adjust payroll obligations in your company file.

- From the Reports menu, select Employees and Payroll, then select PD7A Report.

- Next, select a date range.

- Also, select Employees and Wage Obligations.

- After that, adjust wage debt.

What is Payroll Liability in QuickBooks?

Payroll liability in QuickBooks includes employee wages, payroll taxes, employee training, and service costs.

How do I set payroll liability to zero in QuickBooks Desktop?

To do this, you need to do the following:

- Select the employee and also go to Payroll.

- Additionally, you must select the Salary Debt tab.

- Also, select Change Payment Method from the Other Activities drop-down list.

- Next, select Benefits and Other Payments in the QuickBooks Payroll Setup window.

Other Related Articles:

How to Create a Journal Entry in QuickBooks Desktop?

QuickBooks File Doctor: How to Repair your Damaged Company file or Network?

How to Upgrade to a new QuickBooks Desktop Version?

How to Fix QuickBooks Error 80070057 While Opening a Company File?