Writing off bad debts is a common thing in accounting and bookkeeping. Same task is carried out in QuickBooks accounting software as well. In order to write off bad debts in QuickBooks desktop or online, there are certain steps that can be followed. Writing off bad debts is a must, as the user might face issues during the bank reconciliation and it will also assist in avoiding discrepancies and profit/loss statements. By writing off bad debts in QuickBooks, one can clear the invoices from the account receivables that assist in getting the appropriate profit amount. Considering the importance of writing off bad debts in QuickBooks, we have come up with this piece of information. Thus, keep reading further to elevate your understanding of the writing off bad debts in QuickBooks.

Additionally, if you require any sort of technical assistance or if want our ProAdvisors to guide you through the process in detail, then in that scenario, you can simply place a call at +1-844-719-2859. And speak to our accounting professionals regarding the same. Our support team will ensure to guide you with the most relevant information instantly.

You may also like: How to Fix QuickBooks Error H202, and H505?

What is meant by Bad debts?

Bad debts basically mean an amount that is unable to recover from the debtor. Debtor is the one who owe you some amount of money i.e. the borrower. When the debtor is unable to pay the amount, it is termed as bad debt. Debt issues can affect the profit and loss reports while reconciling the accounts in QuickBooks. Bad debts relate to the account receivables and are referred as non-collectible account. In case the business uses accrual method of accounting, bad debts can be written of as a deduction. Writing off bad debts ensures the accounts receivable and net income to stay updated.

All-in-all bad debt is a terminology that is used when the user sells goods on credit, and the customer didn’t pay. The entire process to write off bad debts in QuickBooks is discussed later in this article.

Read Also: How to Fix QuickBooks Web Connector Error QBWC1085?

Steps to write off bad debts in QuickBooks desktop

If you are a QuickBooks desktop user, then the steps listed below would surely help you in writing off bad debts. Let us explore the steps carefully:

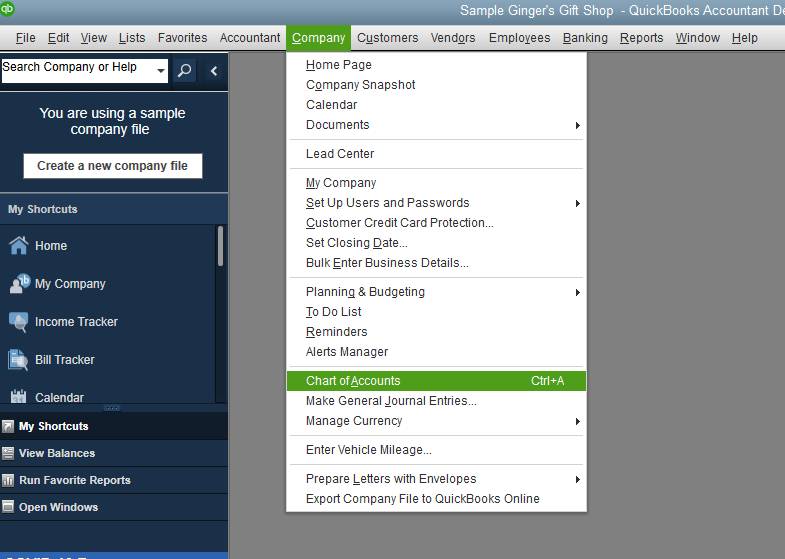

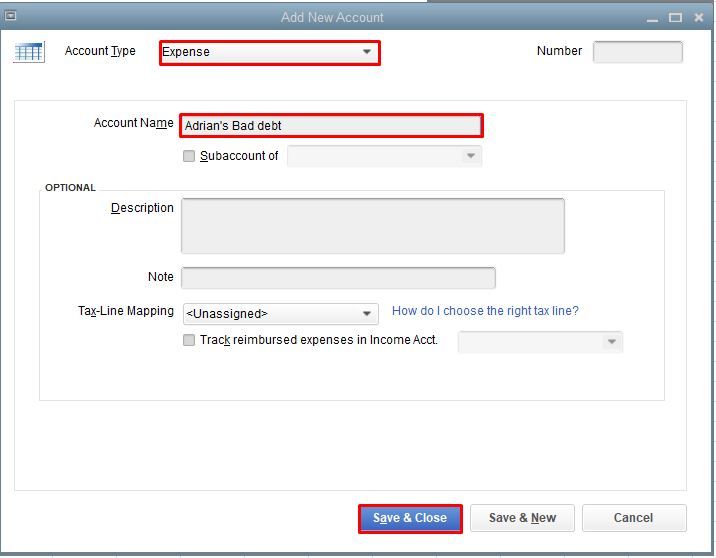

Step 1: Creating an expense account named bad debt

- In this step, the user is required to move to the lists in the top navigation bar and then choose the company option

- After that, the user is required to navigate to the chart of accounts

- The next step is to create a new expense account by clicking on the account tab and then hit new

- The user is then required to select expenses

- Once done with that, type in bad debt in the account name field and also choose save and close tab.

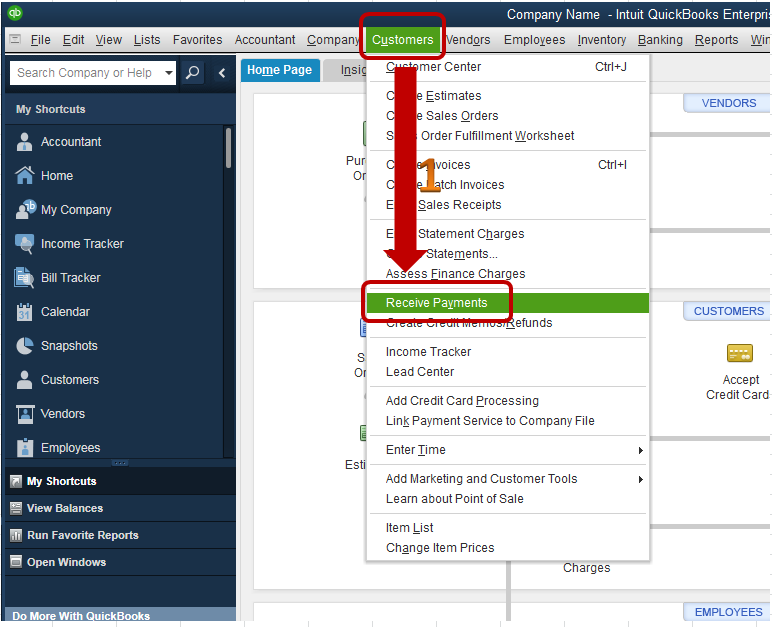

Step 2: Recording and Closing the bad debt

- After following the above step, the user is required to choose the receive payments tab in the customer-menu

- Followed by entering the customer’s name in the receive from and $0.00 in the payment amount. Important point: In the description the user can write invoice number of the bad debt for tracking.

- The next step is to click on the discount and credits tab

- Also, enter the amount of bad debt the user wishes to write off in the amount of discount field.

- Now, in the discount account, the user is supposed to choose the bad debt account that was created in the above step

- The last step here is to click on save and close tabs.

Steps to write off bad debts in QuickBooks Online (qbo)

The above steps were only for QB desktop users. However, if you are QuickBooks online user, then the steps listed below would be applicable for you, if you want to write off bad debts in QuickBooks online.

Step 1: Review the aging report for Accounts receivable

The very first thing that one needs to do before writing off the bad debts in QuickBooks online is to review the aging report for accounts receivable. This can be done as follows:

- The user is recommended to use the left side menu for opening the reports section

- Once done with that, the user is supposed to open the search bar

- Look for the account receivable aging report from the search bar

- And then, check the outstanding receivable account.

- The user should also click on the accounts receivable aging detail report.

Read it also: What is component repair tool in QuickBooks?

Step 2: Making of bad debt account in QuickBooks

- In this step, tap on the gear icon from the company section.

- Followed by selecting the chart of accounts tab

- The next step is to choose the option to create a new account

- And also, click on the expenses option from the account type drop-down list

- Once done with that, the user needs to choose all the bad debts from the detail type drop-down list and also type in bad debt in the name field

- The last step is to click on save and close to end this process.

Step 3: Setting up a service/ product bad debt item

- For this, the user is required to click on the gear icon and also choose the product and services tab from the lists section

- Now, click on the new product and then from the product/service information section, click on the non-inventory tab

- The next step is to type bad debt in the name text box

- Followed by selecting bad debt expenditure created in the income account section

- Once done with that, the user is supposed to unmark the “Is Taxable” check-box

- And lastly, click on the save and close tab

Read this also: How to solve QuickBooks Multi-user mode not working error?

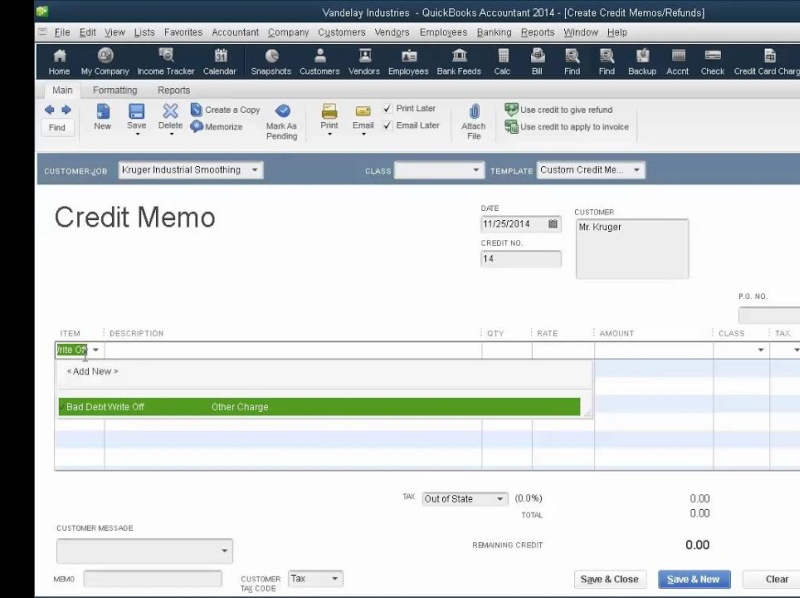

Step 4: Setting up a credit memo for bad debt

- In this step, the user needs to click on the plus icon at the top of the QuickBooks dashboard

- Followed by selecting the credit memo under the customers section

- And then, select the customer from the customer drop-down list

- The next step is to select the item that has been created for the bad debt in the product/service field

- Once done with that type in the amount of the bad debt/unpaid invoices with positive values

- Move ahead to the memo text box and also type in the bad debt amount

- The last step here is to click on save and close tabs.

Step 5: Implementing the credit memo to apply for credits

- The user needs to start the process off by clicking the plus tab on top of the screen and then move to the receive payment from the customer’s section.

- After that, choose the customer from the drop-down list

- And also choose the invoice to be written off from the outstanding transactions menu

- Now, choose the credit memo that was created from under the credits section

- The next step is to run a check and affirm that the amount reflecting in that section is $0.00

- Towards the end, the user needs to click on save and close tab and you are good to go.

See Also: Convert a QuickBooks for Windows file to QuickBooks for Mac

To Wrap it Up!

This was a prolonged discussion about the process to write off bad debts in QuickBooks. After scrutinizing this article, we assume that you might be able to write off bad debts in QuickBooks successfully.

Despite that if you are confused regarding writing off bad debts in QuickBooks or if you are stuck at any stage, then have a one-on-one conversation with QuickBooks pro support team and certified accounting professionals. Get on the line at our toll-free number i.e. +1-844-719-2859, and we will take care of the rest.